Climate change is one of the most serious issues in modern times and carbon reduction has become a common goal of countries and corporations so as to keep the temperature rise within 1.5℃, which goes in tandem with carbon budgets, carbon neutrality, to the latest goal of net zero by 2050. What does net zero, which directly impact the economy, mean? This article will define net zero and address its importance to humanity and corporations along with case studies for corporations to better work towards net zero.

What is net zero?

According to the IPCC, to keep the global temperature rise at 1.5℃, the remaining carbon budget (the remaining emission cap for humanity) stands at only 500 gigatons remaining. The carbon emission in 2019 was 59±6.6 gigatons CO2, and carbon emissions are increasing every year; this means that if all remains constant, the carbon budget will be exceeded within 10 years.

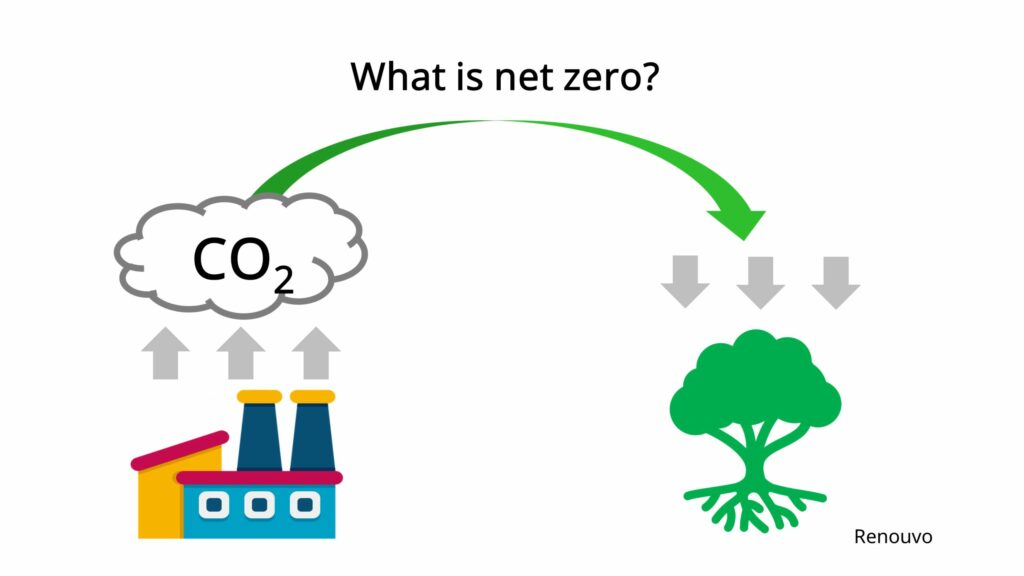

To meet the carbon budget, the IPCC has proposed that GHG emissions must be reduced by 45% by 2030, and net zero must be achieved by 2050. This means that humanity’s total GHG emission is equal to the artificially created carbon sink. Greenhous gases include CO2, CH4, FCs, etc. Carbon sinks are systems where CO2 absorptions higher than their carbon emissions, and examples of carbon sinks include forests, soil, and oceans. To achieve net zero, we must work towards two goals: reducing man-made emissions and creating artificial carbon sinks to ultimately achieve net zero by balancing both emissions and removal of GHGs.

Why is the world working on net-zero? How does it help to achieve climate change?

Imange: Unsplash / Colin Lloyd

The IPCC has pointed out that the average temperature between 2006-2015 is 0.87°C higher than that between 1850-1990, meaning artificial greenhouse gases have greatly increased the temperature by 0.2°C per decade.

The global temperature rise leads to rising sea levels, extreme temperatures, and the increase of the frequency and intensity of rainfalls and droughts. For example, in 2022, Europe had the hottest June to August in history, with resulting heat and wildfires causing more than a thousand deaths. The U.S. also had the coldest Christmas eve in 40 years with a storm that caused more than 50 deaths. Controlling greenhouse gas emissions, therefore, has become an urgent issue.

To prevent climate change inflicting catastrophic impact on humanity, the IPCC proposed a plan to control the temperature rise to 1.5-2°C since the Industrial Revolution. To keep the temperature rise at 1.5°C, global greenhouse gas emissions must be reduced by 45% by 2030 and net zero must be achieve before 2050.

Global Government Net Zero by 2050 Measures

Caps and trade

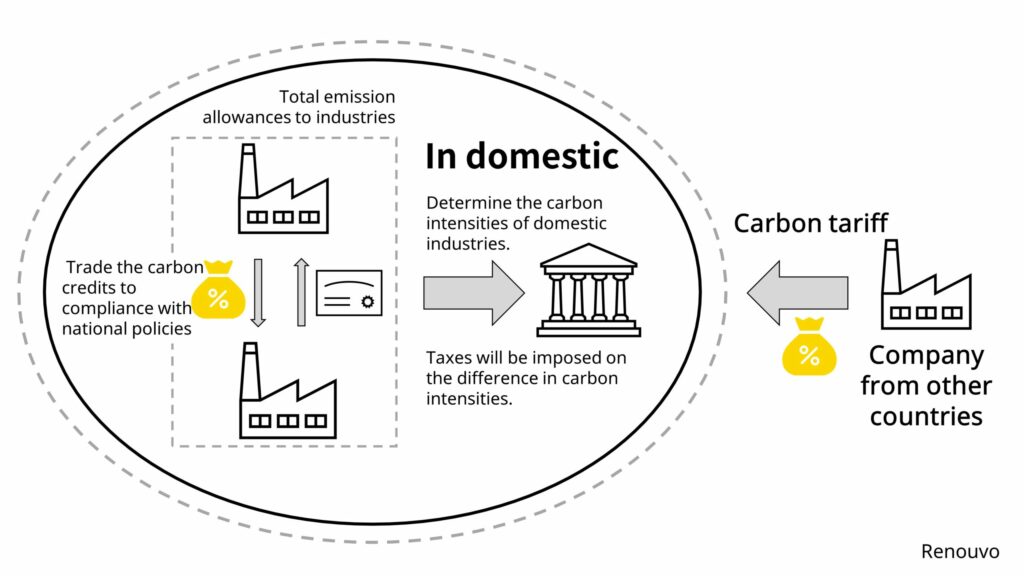

Carbon caps and trading would first be regulated by a country as it assigns total emission allowances to industries based on the carbon reduction goal. The allowed emission cap a corporation receives is based on the total allowance, and the assignment formula is called the “carbon allowances.” Each year, when a corporation produces spare carbon credits by carbon reduction or other means, the corporation can trade these carbon credits with corporations which are short of carbon allowances on the market. Carbon credit markets have emerged in the EU, South Korea, Japan, the U.S., and China.

Carbon border adjustment mechanism

Besides domestic regulations on carbon reduction, carbon emission is also seen as part of the international fair-trade competencies as carbon reduction requires equipment upgrades and green energy, which incur higher costs. The EU and the U.S. would soon propose carbon border taxes and determine the carbon intensities (the carbon dioxide emission per GDP, the formula being the carbon emission divided by the total revenue) of domestic industries. If the desired imported products have higher carbon intensities than the domestic ones, taxes will be imposed on the difference in carbon intensities. This is estimated to be implemented in 2023-2024, and will impact industries with high carbon intensities such as the steel, concrete, and fertilizer industries.

Net Zero’s benefits to corporates

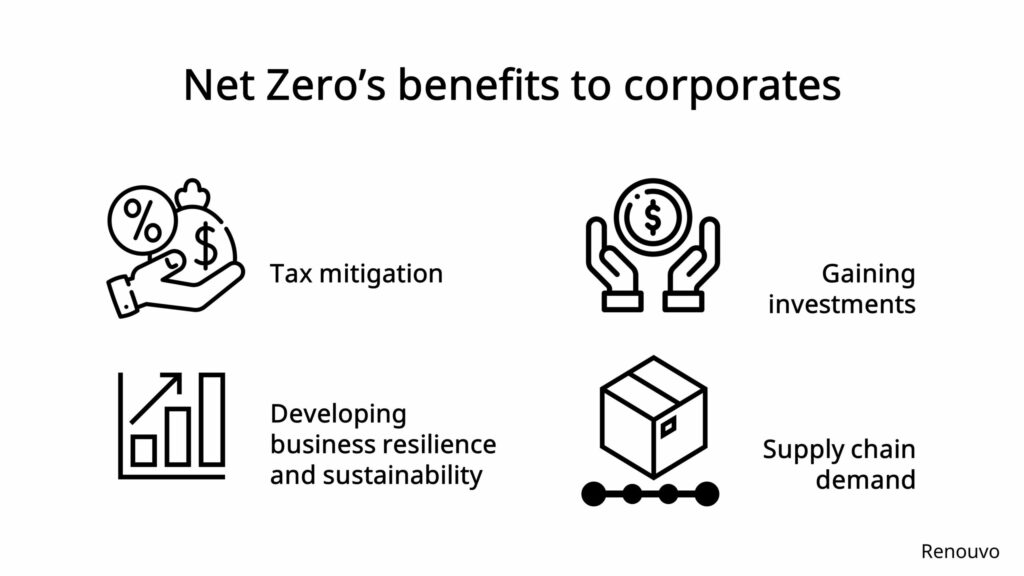

Tax mitigation

According to the World Bank, by April 2022, there are 47 countries in the world with fuel carbon taxes, carbon emission controls, and domestic carbon credit markets which might raise the costs of fossil fuel energies for the retail electric industry and thus impact corporations. Various countries are also proposing carbon border taxes. If the carbon intensities are higher than the average carbon intensities of the industries in the desired export destination, manufacturers for importing goods would have to face additional costs.

Exceeding carbon allowances issued by the country will lead to a fine multiple times higher than the average price on the carbon credit market. Besides, certain countries have energy consumption limits for certain products. For example, the EU has set an automobile emission control goal (Euro 7 in 2022) which requires car manufacturers to keep the average fuel economy lower than a set figure or face a massive fines if otherwise. In one case, Ford faced a 100 million fine in 2020.

Developing business resilience and sustainability

The COP26 has officially proposed the goal of gradually replacing fossil fuels. Moreover, in recent years, elements such as the pandemic and war have disrupted the global supply chain, destabilizing the fossil energy market. Reducing the dependency on fossil energies and materials can help corporations respond to the changes in energy prices, energy transformation, and regulations.

Gaining investments

According to the 2020 biennial Global Sustainable Investment Alliance report, amongst all professional investments, ESG investments have reached 36.1% in 2020 with the potential of reaching 50% in 2024. If net-zero can be reached, it would greatly benefit a corporation’s ESG evaluation as it meets the value of sustainable operations. Various banks have proposed concessional loans and investment portfolios for net-zero corporates while decreasing lending to corporates that underperform in net-zero.

Supply chain demand

In response to the trend in carbon reduction, many corporations around the world have announced their carbon reduction targets, joined the RE100 organization, and completely adopted green energy. For example, Apple has achieved operation carbon neutrality in 2020 and promised to do so with its global supply chain by 2030 while demanding its partners to be accountable about their progress towards the goal. According to a press release on Apple’s official website, by October of 2022, more than 200 suppliers have promised to adopt green energy for all Apple-related production activities, which consists of over 70% of Apple’s manufacturing costs. If a corporation is part of a larger corporation’s supply chain, not working towards net zero translates into possible business opportunities lost.

Differences between carbon neutrality and net zero

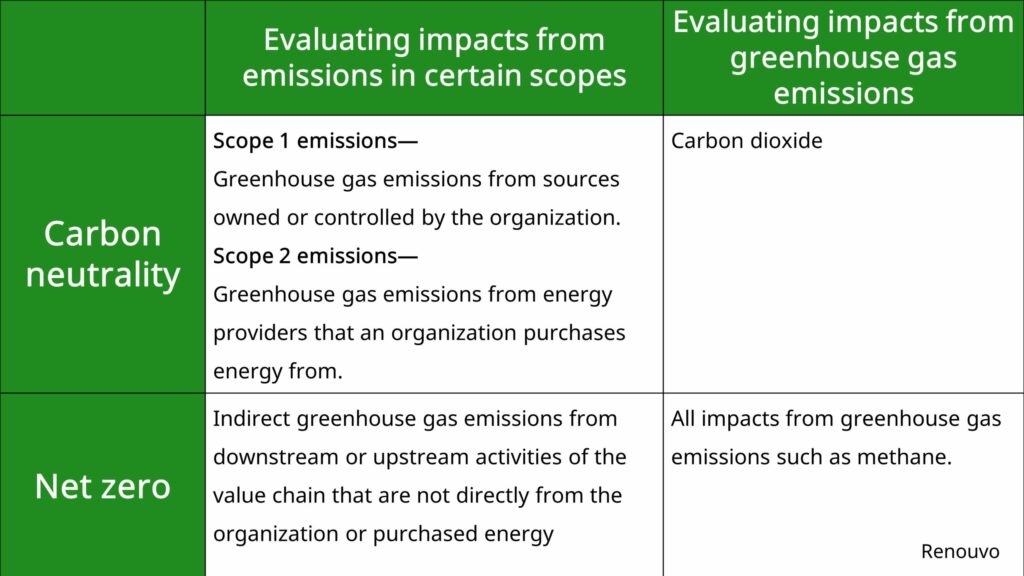

Carbon neutrality and net zero both mean offsetting artificial greenhouse gases through emission reduction and creating carbon sinks (in natural ways such as reforestation or artificial ways such as carbon capture). However, carbon neutrality only requires the neutralization of carbon dioxide emissions in Scope 1 emissions— Greenhouse gas emissions from sources owned or controlled by the organization and Scope 2 emissions— Greenhouse gas emissions from energy providers that an organization purchases energy from, such as indirect emissions from purchased electricity for manufacturing plan fiber cutlery or direct emissions from the combustion engines of logistical vehicles. Net zero on the other hand is comprehensive and full spectrum. Besides evaluating all impacts from greenhouse gas emissions, Scope 3 emissions— indirect greenhouse gas emissions from downstream or upstream activities of the value chain that are not directly from the organization or purchased energy must be included as well. Using the aforementioned plant fiber cutlery for example, the third area would include greenhouse gases from upstream or downstream transportation, carbon emissions converted from water use for cutlery washing, and emissions from product disposal.

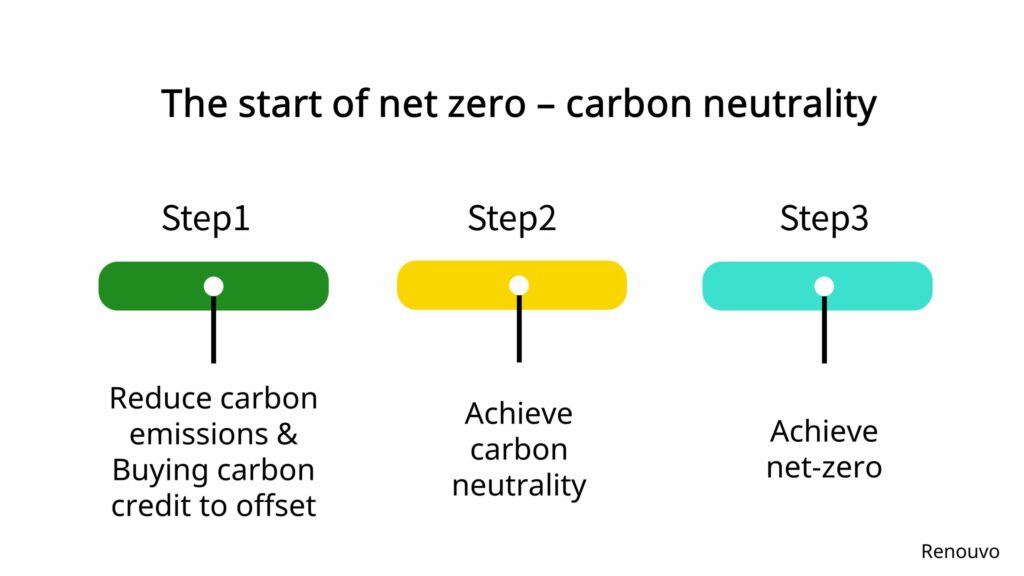

The start of net zero – carbon neutrality

Why start with carbon neutrality?

Net zero demands all GHG emissions to be equal to the absorptions of carbon sinks, which is rather difficult to achieve. Carbon neutrality goals are relatively easier to achieve and has become a short- or mid-term target for corporations when setting their net zero goals. Corporations can start with a single activity or product and work towards the net zero global consensus by 2050.

How do corporates achieve carbon neutrality?

Carbon neutrality requires carbon credits, which are carbon reductions from afforestation, ecological restoration, and both solar and green energy. These projects will be certified and calculated by certain enterprises, which will issue certificates of carbon credits for corporations to offset emissions they cannot reduce in order to achieve carbon neutrality.

Carbon credits are from Voluntary Carbon Markets (VCM) or the Clean Development Mechanism (CDM), which is certified by the UN and conceived by the Kyoto Protocol. CERs from the CDM can be purchased on the UN’s carbon offset platform. The procedure is very simple. One selects the desired project, adds it to the cart, and check out directly to transfer payment to the project. The UN’s official website will send a digital offset certificate to the purchaser, who should select “I am offsetting greenhouse gas emissions for my company.” as its use. After getting the digital certificate, they may use it for carbon offsetting for a corporate.

Carbon credits on voluntary carbon markets are traded by managers and on various platforms. If there is a need for great emission reduction, corporations can establish and invest in projects through platforms or agencies to obtain carbon credits. Some platforms or agencies exclusively sell projects they create and certify while some sell projects created and certified by major enterprises.

Among the 4 major enterprises, only the Gold Standard has its own platform. The other common international platforms and agencies include the AirCarbon Exchange (ACX), the Climate Impact Partners, the Carbon Trade eXchange (CTX), and Xpansiv, from whom carbon credits can be purchased for carbon offsets.

How do corporates achieve net zero?

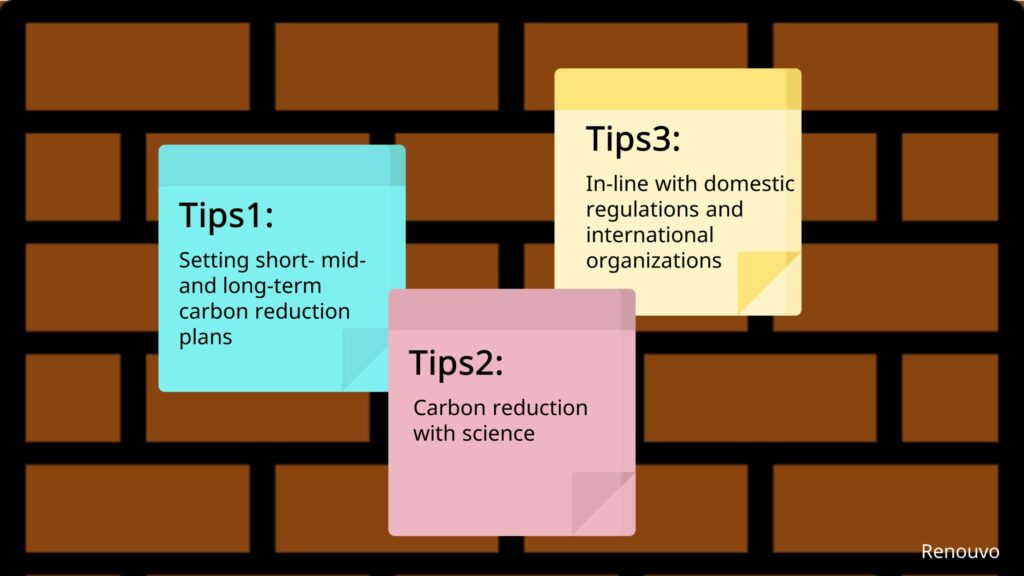

Tips1:Setting short- mid- and long-term carbon reduction plans

Following the COP26 in Glasgow, the global net zero goal by 2050 has been set. Most countries and corporations have set their net zero targets between 2030-2050. This is a long-term goal that takes decades, meaning change won’t happen quickly and short- mid-term goals are needed for it to be achievable. For example, according to the official website of Amazon, it has promised to achieve net zero by 2040. Its short-term goals include investing in renewable energy and afforestation to produce carbon sinks and reducing packaging, etc. Its mid-term goals include using 100% renewable energy for its operation by 2025. Eventually, it would achieve net zero by 2040.

Tips2:Carbon reduction with science

To translate goals into actions, it is crucial to quantify carbon reduction activities. Corporates may start with verifying their carbon footprints. The ISO 14064 and ISO 10467 standards are both international standards for verifying carbon footprints. The verification is divided into three scopes, which can be used to verify a corporation’s direct and indirect carbon emissions from every procedure. After verification, one can find ways to reduce emissions, such as employing energy-saving equipment and electric vehicles, reducing packaging, using recycled materials, etc. One can manage energy use through the ISO 50001 standard and eventually purchase carbon credits approved by the PAS2060 to achieve net zero scientifically.

Tips3:In‑line with domestic regulations and international organizations

Carbon reduction isn’t a battle for corporations to fight alone. Various countries support net zero policies. For example, in the act signed by the U.S. President in 2022, 370 billion U.S. dollars are budgeted for carbon reduction and green technology promotion, including tax reduction for clean energy production, pollution reduction, and encouraging consumers to purchase appliances and heat pumps to improve household energy efficiency. It means that companies in this industry may improve competitiveness in terms of prices and thus lowering the cost for corporates to employ energy-saving equipment and green energy for carbon neutrality. If one complies with government policies, its path to net zero may go more smoothly.

Moreover, many corporations have formed alliances to promote net zero. For example, the RE100, which has announced to replace fossil fuels with 100% green energy, consists of international corporations such as Apple, Amazon, Microsoft, Google, etc. There is also the French R20 Paris, which initiates net zero activities in the education, economy, and ecological spheres These are all organizations corporations may consider signing and joining. In them, corporates may discuss carbon reduction progresses and encourage each other as they work towards the goal of net zero.

Conclusion

Net zero by 2050 has become a global consensus. Every corporation is being influenced by the change of regulations, the adjustment of supply chain procurement policies, and energy crises. Only by setting targets which are either similar or supersedes net zero, scientifically verify carbon footprints, continuously reduce energy use, and utilizing green energy can one gain the ability to sustainably operate as far as the economic issue of carbon emissions is concerned.