Climate change has threatened the future of humanity. After recent international summits, many countries have established policies on carbon emissions and carbon taxes, escalating carbon reduction issues from a previously moral issue to a current economic issue, hence directly impacting the operations of corporations, with carbon neutrality becoming one of these popular terms. This article will define carbon neutrality, its importance to corporations and the world, as well as how corporations can achieve carbon neutrality.

What is carbon neutrality?

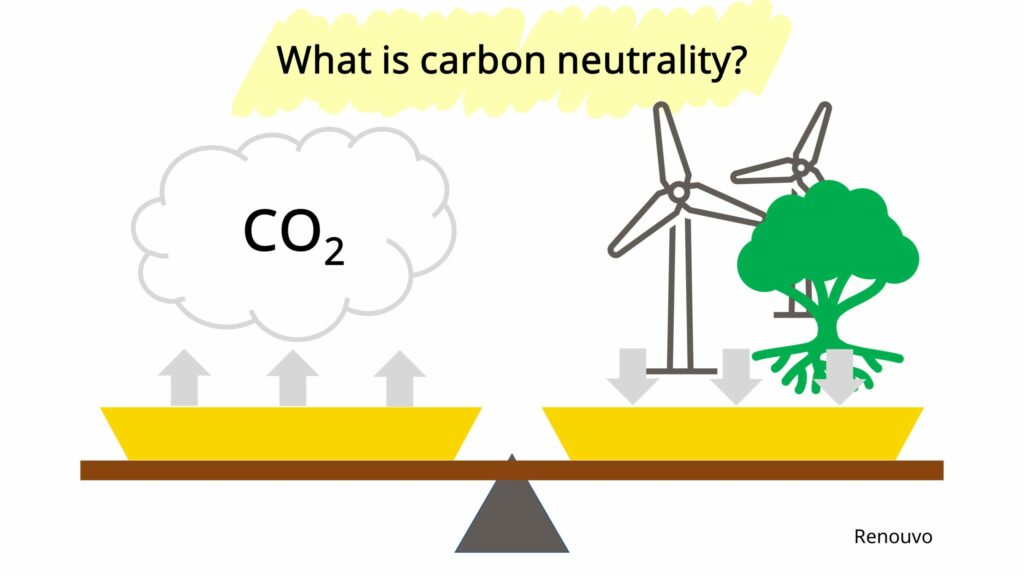

Amidst this trend of carbon reduction, carbon neutrality has become one of the objectives in controlling rising global temperature. The initial definition of carbon neutrality is the reaching of a balance between carbon emissions and carbon sinks (systems with higher carbon dioxide absorption than carbon emissions, such as forests, soil, and oceans) during a particular period, thereby removing the additional carbon dioxide emissions produced by humans.

On a smaller scale, when carbon neutrality is set out as a goal for countries and corporations, it is mainly achieved through source carbon reduction and end offset. Carbon emissions are first reduced to the minimum, then carbon offsets such as afforestation, soil carbon enhancement, peatland restoration, and direct air carbon capture and storage (DACCS) are implemented to artificially create carbon sinks and hence achieve carbon neutrality. For example, airlines offer carbon neutral flights and oil firms offer carbon neutral trips. Such business activities still produce carbon emissions, but carbon neutrality is achieved through carbon offsets.

Why is the world working on carbon neutrality? How does it help to achieve climate change?

Imange: Pexels / GEORGE DESIPRIS

The IPCC has pointed out that the average temperature between 2006-2015 is 0.87°C higher than that between 1850-1990, meaning artificial greenhouse gases have greatly increased the temperature by 0.2°C per decade.

The global temperature rise leads to rising sea levels, extreme temperatures, and the increase of the frequency and intensity of rainfalls and droughts. For example, in 2022, Europe had the hottest June to August in history, with resulting heat and wildfires causing more than a thousand deaths. The U.S. also had the coldest Christmas eve in 40 years with a storm that caused more than 50 deaths. Controlling greenhouse gas emissions, therefore, has become an urgent issue.

To prevent climate change inflicting catastrophic impact on humanity, the IPCC proposed a plan to control the temperature rise to 1.5-2°C since the Industrial Revolution. To keep the temperature rise at 1.5°C, global greenhouse gas emissions must be reduced by 45% by 2030 and net zero (the total greenhouse gas emission equaling the carbon sink) must be achieve before 2050. Carbon neutrality is the first step in carbon reduction as it helps remove the carbon emissions of individuals, activities, corporations, or even countries.

Global governments achieving carbon neutrality by 2050 and the status quo

Cap and Trade

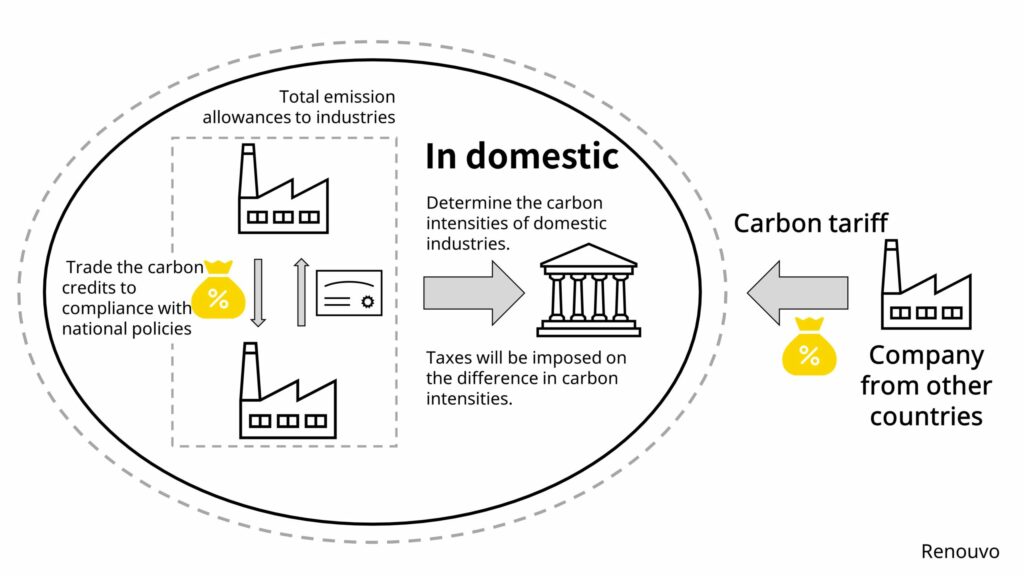

Carbon caps and trading would first be regulated by a country as it assigns total emission allowances to industries based on the carbon reduction goal. The allowed emission cap a corporation receives is based on the total allowance, and the assignment formula is called the “carbon allowances.” Each year, when a corporation produces spare carbon credits by carbon reduction or other means, the corporation can trade these carbon credits with corporations which are short of carbon allowances on the market. Carbon credit markets have emerged in the EU, South Korea, Japan, the U.S., and China.

Carbon border adjustment mechanism

Besides domestic regulations on carbon reduction, carbon emission is also seen as part of the international fair-trade competencies as carbon reduction requires equipment upgrades and green energy, which incur higher costs. The EU and the U.S. would soon propose carbon border taxes and determine the carbon intensities (the carbon dioxide emission per GDP, the formula being the carbon emission divided by the total revenue) of domestic industries. If the desired imported products have higher carbon intensities than the domestic ones, taxes will be imposed on the difference in carbon intensities. This is estimated to be implemented in 2023-2024, and will impact industries with high carbon intensities such as the steel, concrete, and fertilizer industries.

Why should corporations achieve carbon neutrality? How does it benefit them?

Compliance with national policies

According to the World Bank, by April 2022, there are 47 countries in the world with fuel carbon taxes, carbon emission controls, and domestic carbon credit markets which might raise the costs of fossil fuel energies for the retail electric industry and thus impact corporations. Various countries are also proposing carbon border taxes. If the carbon intensities are higher than the average carbon intensities of the industries in the desired export destination, manufacturers for importing goods would have to face additional costs.

Exceeding carbon allowances issued by the country will lead to a fine multiple times higher than the average price on the carbon credit market. Besides, certain countries have energy consumption limits for certain products. For example, the EU has set an automobile emission control goal (Euro 7 in 2022) which requires car manufacturers to keep the average fuel economy lower than a set figure or face a massive fines if otherwise. In one case, Ford faced a 100 million fine in 2020.

Developing business resilience and sustainability

The COP26 has officially proposed the goal of gradually replacing fossil fuels. Moreover, in recent years, elements such as the pandemic and war have disrupted the global supply chain, destabilizing the fossil energy market. Reducing the dependency on fossil energies and materials can help corporations respond to the changes in energy prices, energy transformation, and regulations.

Consumers’ interest

Climate Neutral’s simulated market study revealed that 87% of the Americans prefer carbon-neutral labeled product while 92% of them perceive carbon-neutral labeled products to be of higher quality. Offering carbon neutral products and services to become a carbon neutral corporation helps improve their image and meet consumers’ expectation of sustainable consumption.

If the sales target is other companies, there are many corporations with net zero plans, which rely on the entire supply chain to reduce carbon emissions. Therefore, some sales terminal brands, such as Apple, have requested their supply chains to reduce emissions or even achieve carbon neutrality. If carbon neutrality can be achieved, it would help meet their clients’ needs and improve product competitiveness.

Gaining investments

According to the 2020 biennial Global Sustainable Investment Alliance report, amongst all professional investments, ESG investments have reached 36.1% in 2020 with the potential of reaching 50% in 2024. If carbon neutrality can be reached, it would greatly benefit a corporation’s ESG evaluation as it meets the value of sustainable operations. Various banks have proposed concessional loans and investment portfolios for carbon neutral corporates while decreasing lending to corporates that underperform in carbon neutrality.

Differences between carbon neutrality and net zero

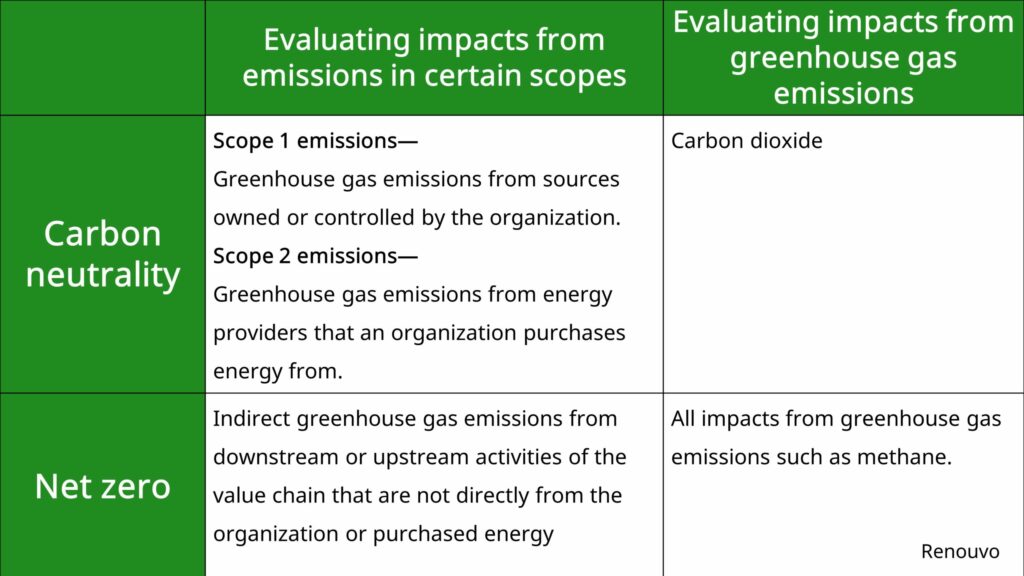

Carbon neutrality and net zero both mean offsetting artificial greenhouse gases through emission reduction and creating carbon sinks (in natural ways such as reforestation or artificial ways such as carbon capture). However, carbon neutrality only requires the neutralization of carbon dioxide emissions in Scope 1 emissions— Greenhouse gas emissions from sources owned or controlled by the organization and Scope 2 emissions— Greenhouse gas emissions from energy providers that an organization purchases energy from, such as indirect emissions from purchased electricity for manufacturing plan fiber cutlery or direct emissions from the combustion engines of logistical vehicles. Net zero on the other hand is comprehensive and full spectrum. Besides evaluating all impacts from greenhouse gas emissions, Scope 3 emissions— indirect greenhouse gas emissions from downstream or upstream activities of the value chain that are not directly from the organization or purchased energy must be included as well. Using the aforementioned plant fiber cutlery for example, the third area would include greenhouse gases from upstream or downstream transportation, carbon emissions converted from water use for cutlery washing, and emissions from product disposal.

Ways for corporation carbon neutrality – carbon offsets

Imange: Pexels / Nejc Košir

Why carbon offsets?

Even if only direct and indirect carbon dioxide emissions are counted, it is still difficult to eliminate all emissions. One can only reduce emissions and offset the remaining emissions.

Carbon offset, Carbon credits & Carbon allowances

Carbon offsets, carbon credits, and carbon allowances are often mentioned together. Carbon offsets are needed for carbon neutrality. Then, should one achieve carbon offsets with carbon allowances or carbon credits?

Carbon allowances are annual emission allowances assigned to a corporation yearly by the country with carbon restrictions. Basically, carbon allowances can only be domestically traded to meet local regulations. They cannot be traded internationally, help corporations achieve carbon neutrality, or used for carbon offsets.

Mainly used by corporations that reduce voluntarily carbon emissions, carbon credits are from carbon reduction programs such as afforestation, ecological restoration, solar power, or green energy. They can be traded internationally and help corporations with carbon offsets. Some countries also accept carbon credits obtained through certain means to lower the calculated emission amount generated by a corporation to comply with the regulated caps.

Common carbon credit categories

Carbon credits are needed for carbon offsets and are mostly obtained from Voluntary Carbon Markets (VCM) or the Clean Development Mechanism (CDM), which is certified by the UN and defined by the Kyoto Protocol. Voluntary carbon markets are formed by non-governmental, independent corporations. The following 4 certification enterprises are the most recognized by the market: the Verified Carbon Standard (VCS/Verra), the Climate Action Reserve (CAR), the Gold Standard (GS), and the American Carbon Registry (ACR). As each corporation executes and evaluates carbon reduction projects in different ways and aspects, investors, supply chains, and authorities might not always accept their carbon credits for offsetting.

How to get carbon credits for carbon offsets?

Carbon credits on voluntary carbon markets are traded by managers and on various platforms. If there is a need for great emission reduction, corporations can establish and invest in projects through platforms or agencies to obtain carbon credits. Some platforms or agencies exclusively sell projects they create and certify while some sell projects created and certified by major enterprises.

Among the 4 major enterprises, only the Gold Standard has its own platform. The other common international platforms and agencies include the AirCarbon Exchange (ACX), the Climate Impact Partners, the Carbon Trade eXchange (CTX), and Xpansiv, from whom carbon credits can be purchased for carbon offsets.

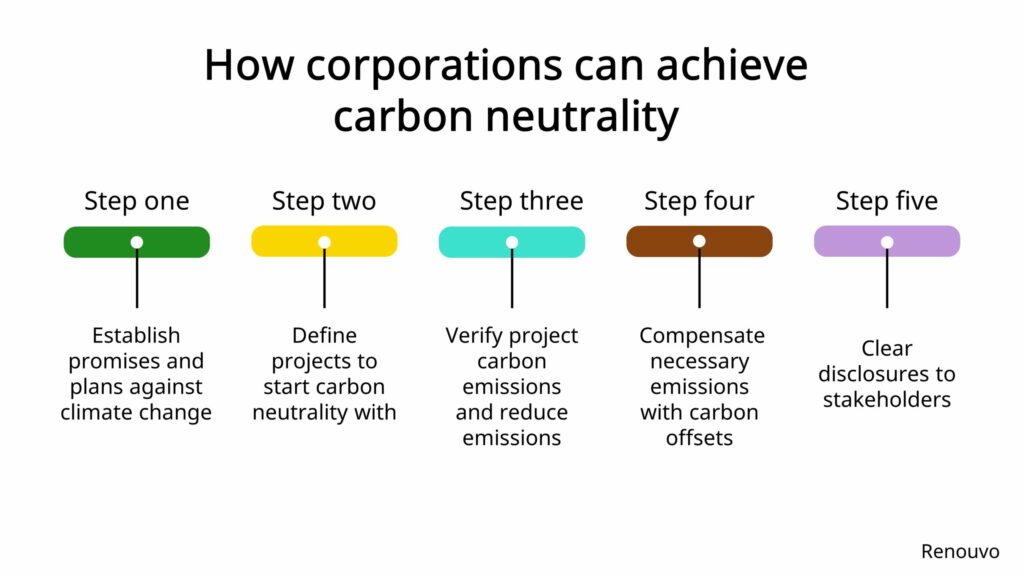

How corporations can achieve carbon neutrality

Step one: Establish promises and plans against climate change

Climate change has become an issue every citizen on Earth has to face and address. It is crucial for corporates to promise carbon neutrality and even net zero. Many corporations have set the goal of carbon neutrality or net zero between 2030-2050. A long‑term goal must have short- or mid-term goals to be practical. To follow international trends, one can join the Science Based Target initiative (SBTi) to set a science-based reduction target according to the SBTi and submit it to be reviewed and published by the SBTi.

Step two: Define projects to start carbon neutrality with

Corporates produce carbon emissions in many ways. One shall define projects they wish to achieve carbon neutrality with according to their reduction targets. One can start with a single business activity, such as carbon neutralize a certain product, and improve gradually until the entire organization achieves net zero.

Step three: Verify project carbon emissions and reduce emissions

When the project for carbon neutrality has been decided, the corporation should verify the carbon emissions to see which parts have higher emissions or room for improvement to implement improvement measures such as introducing energy-saving equipment, electric cars and scooters, reducing package materials, or using recycled materials or adopt the ISO 50001 standard to systemically improve energy use.

Step four: Compensate necessary emissions with carbon offsets

When carbon emissions cannot be further lowered, corporations can purchase carbon credits from agencies or organizations to achieve carbon neutrality. Note that if carbon neutrality is needed for a certain purpose, such as complying authority regulations or investor policies, corporates should select carbon credits certified by standards approved by the certain enterprises. For example, Carbon Offsetting and Reduction Scheme for International Aviation only approves 9 enterprises including ACR, ART, CDM, CAR and others (as of 2022/11/25). If international credibility is needed, a corporate can seek third-party corporations such as SGS or BSI for certification of its carbon neutrality declaration according to the PAS2060 standard with the ISO14064, 14067 carbon footprint verification.

Step five: Clear disclosures to stakeholders

When a corporate achieves carbon neutrality, it can disclose its results to stakeholders such as consumers, supply chain, investors, and authorities. Besides corporate press releases or announcements, corporations can utilize the TCFD or other structures to include it in its ESG report so its carbon neutrality case can be reviewed and exchanged with other corporates in the industry. This article addresses the importance of ESG.

Conclusion

Carbon neutrality has become a trend that local regulators, the global supply chain, or even consumers and investors are gradually starting to demand. Corporations which achieve carbon neutrality before other corporations have advantages in taxes or client preferences. If a corporation wishes to achieve carbon neutrality, it can reduce carbon emissions first then purchase carbon credits for carbon offsets.